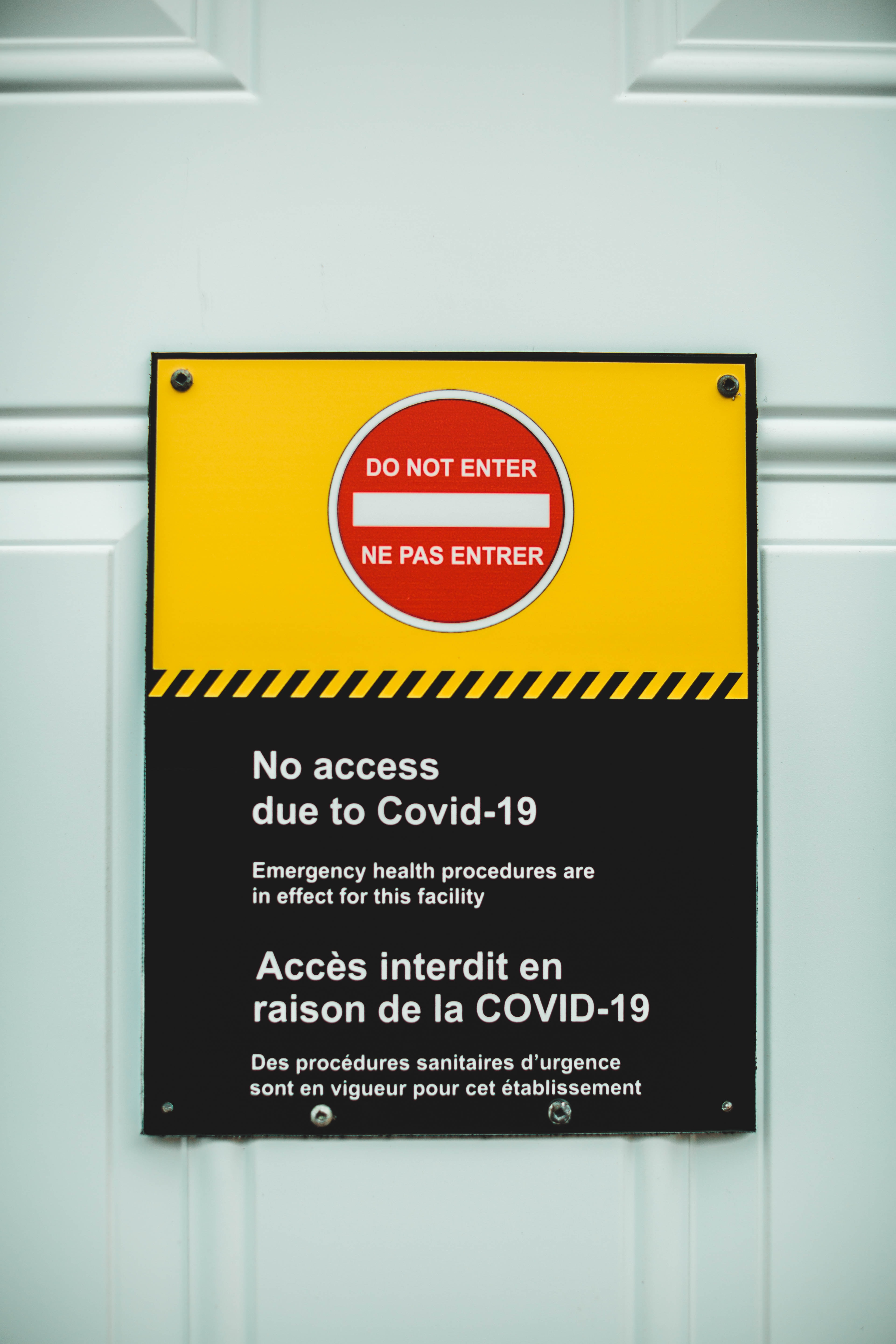

Covid-19

With the ever-growing number of mortgage defaults due to the COVID-19, there is very little understanding or research into the psychological impact of losing one’s home. Instead of having sympathy for such homeowners, many people blame them for their own problems.

HARDER TO PAY MORTGAGES

The pain and despair people suffer every day is inexplicable. But the loss of one home is often met by stern reproaches. People say, “Repossession is not the end of the world. You will be a stronger person from this. You will move on to a better place.”

The banks will do what they must do. You are just another number in the bank’s records. That is life. Everyone has problems.

Covid-19 has made it harder for millions of homeowners to pay their mortgages.

The principal, interest and escrow payments that would have become due during the forbearance do not go away. The borrower is still legally obligated to make them. The CARES Act does not say anything about how these payments are to be made. Each federally backed mortgage program has issued guidance on how servicers should proceed.

People’s circumstances change.

The Central Bank concerns itself rightly so with borrowing costs and repayment potential. But we live in a world with this horrible pandemic where a job for life is no longer a guarantee or exists anymore. More and more business owners are shutting their business, or marriages fall apart. And people are suffering from tremendous stresses as well as mental illnesses at various points in their lives. Especially the worries and anxiety of those who are unable to keep their homes.

HOMEOWNER OPTIONS: SELL AND MOVE OUT

Moving brings a lot of emotions, from sadness and fear to joy and excitement; it’s an extreme emotional rollercoaster. Even more so when you are moving with children.

It’s not easy “being in a position to be forced to move out of my house as it’s sad, it makes one ashamed of losing their home. Plus, people's judgmental attitudes make it harder.”

No one deliberately sets out to rip apart the foundations of their home by simply not making mortgage repayments.

HOMEOWNER OPTIONS: REFINANCE

Even though interest rates are currently very low, unfortunately, if the homeowner is out of work and has no income, or their credit score has dropped for non-mortgage payments, they will not be able to take advantage of the low interest rate to be able to refinance.

HOMEOWNER OPTIONS: LOAN MODIFICATION

In certain situation some lenders will offer homeowners loan modification.

When a home owner wasn’t able to make the mortgage payments after their forbearance period expired, at this stage the lender will report the previous missed mortgage payments to the credit bureau, and the home owner Ficor score will drastically drop and that negative reporting will remain in the person’s records for many years. Also many credit card lines may also drop drastically which will result in difficulty for the homeowner to get any further credit for very long time, or it will be with very high interest rates.

HOMEOWNER OPTIONS: BANKRUPTCY AND OR FORECLOSURE

These maybe the last options and should be avoided if possible since these two negative events will also remain on record for many years.

I am a homeowner deep in financial trouble

UNCERTAINTY is the most painful in a time like this.

If I list my home as for sale, will I be able to get the price I need after paying commissions and closing costs?

Will the potential buyers qualify to get a loan?

Will the Appraisal come in at value?

Will the buyer have "buyer’s remorse"?

Will the buyer tie up my house and drag the closing?

Will I be able to close within the time I need to close?

Will moving be an easy transition?

Whatever the reasons to move to a new place, or to new city, such a life-changing step is not to be taken lightly. There will be many ups and downs on your journey, and you need to be aware of both the good and the bad things that will result from your decision.

So, if you are thinking of moving to a new city, make sure you consider all the advantages and disadvantages of your eventual relocation first. This way you will know what challenges you will face and what benefits you can get, and you will be able to make the right choice for you.

THE PROS FOR NOT MOVING.

- 1

Your home is your castle; you know your home, and you love your home

- 2

You have good memories.

- 3

Your kids grew up in that house.

- 4

You home is close to place of your work.

- 5

You know your neighborhood and neighbors.

- 6

No need to change kid’s school, doctor, dentist, banks, shopping.

- 7

The cost and stress of packing and moving, and it’s extremely stressful to pack and unpack again.

- 8

You are emotionally connected to your house.

- 9

My community and friends are living near me.

- 10

Where do I move? Will I be able to buy or rent another home?

Our Offer

- 1

DON’T MOVE OUT

We will buy your home in cash at fair market value. You can stay living in your house.

- 2

DON’T PAY RENT

You will have the option of making ZERO future rental payments for up to 1-3 years.

- 3

BUY YOUR HOUSE BACK

You will have the option to buy YOUR house back from us at fair market value and at pre-determined price.

- 4

SAVE FOR DOWN PAYMENT PROGRAM

If you able to and wish to make any future monthly payments, 100% will go towards buying back your home, or ANY other home.

- 5

REPAIRS

Your house will be fixed based on the inspection report, and while renting we will be responsible for all future major repairs.

- 6

GET CASH AT CLOSING

Get cash at closing to pay credit cards off. Use some of your cash for any personal or other emergency needs.

We’ll help you find + buy a home you love

No more uncertainty

We will work diligently to meet your time line needs , so that you and your family be able to be stress free as soon as possible.

Security

We will do Home Inspection at no cost to you, then together we will go over the immediate items found on the inspection report to determine the priorities items that needed and must to be repaired first either by you, or buy our license Contractor to insure you be living in comfortable and secure home for many years to come.

Discretion

We will be conducting our business relationship with you with full respect and Discretion. No yard sign , No Advertising , no sharing your personal situation with your neighbors.

Pay fair Market value

Our Goal is to help every one to own their own home , our goal here is not to fix and flip , we will not give you a low ball offer , we will be conduction competitive market Analysis of homes similar to your in close proximity to your neighborhood in order to determine the true fair market value of your home. We will be happy to share our finding with you at no obligation what so ever.

Today, the rental real estate landscape is constantly changing

Growing demand for class B and C multifamily housing

Low inventory of rental properties have spiked rent prices: Rents grew in 54 of the top U.S. 100 cities in 2019

High rent cities provide minimal yield to investors (3-4%)

Rent growth outpacing median household income has caused renters to seek new, more affordable locations or roommates

The current robust economy and stead job growth will continue to drive rents up

Why is home ownership becoming less attandable

- 1

No cash for the down payment , and closing costs

- 2

Real Estate prices are high, and increasing

- 3

Millennials represent 75 million people of the US population, now the largest living generation, and prefer to rent vs own

- 4

Baby Boomers at 72 million would also rather rent, freeing up cash to travel

- 5

Ownership is costly with mortgage payment, property taxes, and HOA dues

- 6

On-going cost of repairs and maintenance

- 7

Long term financial commitment

Our Solution: Rent, or Rent To Own

- 1

Renters don’t need to put up large down payment or closing costs

- 2

Renters don’t feel committed to a specific location for a long-term

- 3

Renters don’t have to worry about paying property taxes, HOA fees and maintenance costs

- 4

Fully furnished may include all living expenses in the rent (Utilities, WIFI, Cable, etc.)

- 5

Properties with Rent to own Option may be a great solution.

Rent To Own: How it works

Home buying is not easy for most people by any mean. So we created an easier way to get into that ideal home sooner than later, and deal with all the stress and paperwork later (while you are relaxed and comfortable in your own very own living room.)

Here is the path of owning your home in the most stressless way ever.

Fellus Group Mission is not just to help everyone to own their home, but also to help to find the perfect home at price that makes sense and affordable.

Fellus Group will have an advantage to win that home for you with strong cash offer.

You can move into your new home within 15-30 days.

You decide when you want to buy, any time after 12 months or not at all. No obligation.

You will rent that house from us with an option to buy it back any time after 2 years at predetermined price.

Portion of your Monthly rent will towards buying the house. (20% -25%).

If you decide not to buy all that saving you will get back.

You pay 1-2% option fee which will be added to your savings when you buy the house (if you do not exercise the option that option money is not refundable)

Homes guideline

You find any your home you like that meets our Homes guide line below

Single Family homes, (Condo and town homes)

Located in certain area of San Diego and Los Angeles county

Value between $400,000- $1,000,000.

Not Investment property (owner occupied only).

No short sale, auction, bank owned, or foreclosure.

No condo that have rental or age restrictions.

HOA dues must not be more than $500 per month.

No major renovation - preferably Move in Ready, with just minor cosmetic renovations. ( line paint and carpet ..etc ).

No unpermitted addition or square Ft.

No past or present mold issues.

No overground pool.

No propane

No septic Tank or well.

Why Choose Us

- 1

Fund Manager has Over 40 Years Experience

The collective experience of the Management team lends itself to evaluating investment opportunities and executing on a short and long term plans.

- 2

Long-Term Relationships

The primary principal, and Management, has established core long term relationships with Real Estate sector professionals in the target markets, enabling us to source and acquire off-market properties that would be otherwise less accessible.

- 3

Proven Track Record

We have overseen an impressive portfolio of properties both in multi-family apartment buildings and single-home ownership from coast to coast, including California, Florida, New York and Mid west.

- 4

Market Expertise

Our in-depth knowledge of the real estate, including expertise in both the ownership and rental markets, are the result of our continued and dedicated attention to the market trends.

- 5

A Different Approach

Compared to our competition, we offer a variety of solutions to:

• Homeowners: Home owners who are in financial difficulties

• Rent to own programs : Tailor made program to renters who wish to own a

home.

• Fully Furnished : fully furnished homes option.

Our biggest value are people

Meet the team

Sholomo Fellus

CEO, Fellus Group

Lee Rubinoff

Financial Analysis

Daniel Fellus

Properties Manager

About The Fellus Group

The Fellus Group vast experience in Residential and commercial income Properties mission is help everyone to own their own home . The Company was formed to

A) Help current Homeowners in financial trouble to keep their home , buy acquiring their home and give them the option to buy it back.

B) Helping these who wanting to own their home but unable to do so at this time.

The Company Acquisition team pursues the acquisition, mainly in a move-in condition in good , safe and affordable locations that meet our Company guideline criteria. Targeting Residential opportunities anywhere, but primary in the California markets from San Diego-to Los Angeles, We may also use look into certain Arizona, Colorado, and other markets according to consumer demand.

The Company is managed by a highly experienced real estate professional with over 40 years of experience in real estate industry , primary the California market.

Picking the right price range.

Fellus Group advantage is that we will be buying the houses based on cash offers which will put us in a favorable position in the eyes of the Agent and the eyes of seller.

Safety Policy

Our Agents and our partner Agents will exercise all safety measures related to Covid-19 when touring homes and have it totally cleaned prior to new residence moving in.

Physical condition

Fellus Group will insure that the houses we buy are in good conditions we will have a home inspection done by certified Home inspection Company (we will cover the cost for the report and repairs) We then immediately address the Hazards items listed on that report first, like Roof, Foundation, Electrical, Plumbing ,Pool , spa Termite etc And insure that are all these are repaired before we close. We will also going to have insurance policy on the house and insist that tenant will have tenant insurance as well. We will also pay to install an alarm in every house. (up to $600)

Quality Service Guarantee

1. Conduct a counseling and information session to identify your needs and goals. Commit to priority availability for meeting your needs.

2. Complete a thorough market search to identify all properties consistent with your needs and price range.

3. Prepare a written Competitive or Comparative Market Analysis for you prior of us making an offer.

4. Monitor and communicate the status and satisfaction of contract contingencies.

5. Accompany you on walk-through property inspection before closing, if provided for in the contract.

6. Attend the closing or escrow (in those states where this is customary).

7. Contact you after the closing to assure the satisfactory completion of all service details.

8. Offer the opportunity to evaluate the service provided through the Quality Service Assurance.